| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which the transaction applies: | |

(2) | Aggregate number of securities to which the transaction applies: | |

(3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of the transaction: | |

(5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

BancFirst Corporation

101 North100 N. Broadway Ave.

Oklahoma City, Oklahoma 73102

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DATE | May | |

TIME | 9: | |

PLACE |

100 North Broadway Avenue, Oklahoma City, Oklahoma 73102. The meeting | |

ITEMS OF BUSINESS | 1. | To elect the |

2. |

| |

|

| |

| To amend the BancFirst Corporation Directors’ Deferred Stock Compensation Plan to increase the number of shares of common stock authorized to be granted subsequent to such amendment to 40,000 | |

| To ratify the appointment of | |

| Advisory vote to approve executive compensation; and | |

5. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. | |

RECORD DATE | In order to vote, you must have been a shareholder at the close of business on | |

PROXY VOTING | Whether or not you attend the meeting in person or via conference call, it is important that your shares be represented and voted. Please vote your shares electronically through the Internet or by telephone or by completing, signing and dating your proxy card and returning it as soon as possible in the enclosed, postage−paid envelope. This proxy is revocable. You can revoke this proxy at any time prior to its exercise at the meeting by following the instructions in the | |

By Order of the Board of Directors: | ||

Randy Foraker Secretary | ||

Oklahoma City, Oklahoma

April 7, 20213, 2024

2

BANCFIRST CORPORATION

20212024 ANNUAL MEETING

PROXY STATEMENT

TABLE OF CONTENTS

Page | |

1 | |

4 | |

5 | |

5 | |

Proposal 2: Amendment of the BancFirst Corporation Directors' Deferred Stock | 6 |

Proposal 3: |

|

|

|

|

|

|

|

| |

9 | |

| |

| |

| |

| |

| |

|

|

19 | |

19 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

23 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

30 | |

| |

| |

| |

32 | |

| |

| |

33 | |

33 | |

34 | |

| |

| |

| |

| |

42 | |

| |

| |

Appendix A: BancFirst Corporation Resolution to Amend the |

|

|

|

|

3

BancFirst Corporation

101 North100 N. Broadway Ave.

Oklahoma City, Oklahoma 73102

PROXY STATEMENT

We are providing these proxy materials in connection with the solicitation of proxies by the Board of Directors of BancFirst Corporation of proxies to be used at our 20212024 Annual Meeting of Shareholders (the “Annual Meeting”). In this proxy statement,Proxy Statement, we refer to the Board of Directors as the “Board,” to BancFirst Corporation as “we,” “us,” “our” or the “Company,” and to our wholly-owned subsidiaries, BancFirst as “BancFirst” and, Pegasus Bank as “Pegasus.”“Pegasus” and Worthington Bank as "Worthington." This proxy statement,Proxy Statement, the accompanying proxy card or voter instruction card and our 20202023 Annual Report on Form 10−K were first mailed to shareholders on or about April 14, 2021.11, 2024. This proxy statementProxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

What matters will be voted on at the Annual Meeting?

You will be voting on:

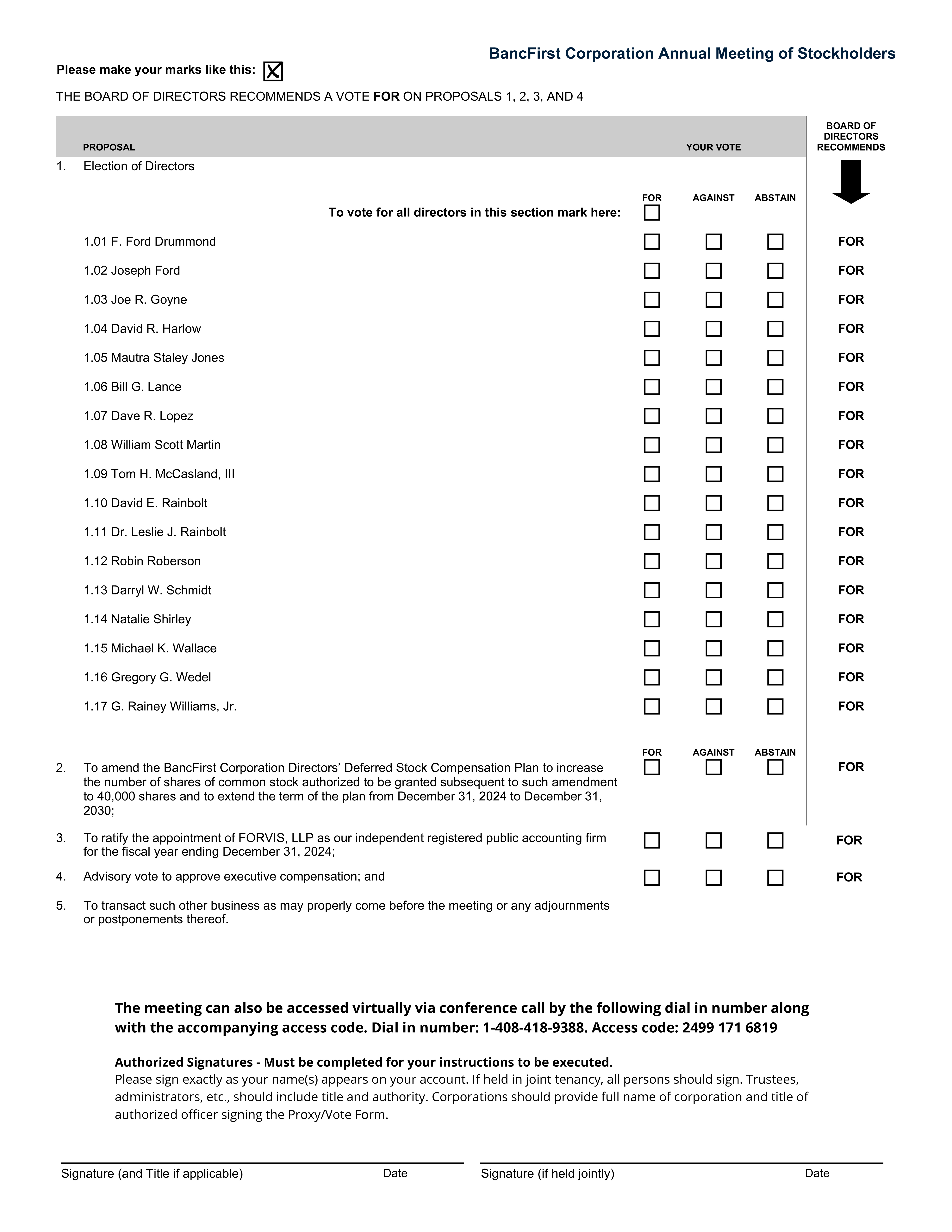

Proposal 1: To elect the 2017 directors nominated by our Board and named in this proxy statement;Proxy Statement;

Proposal 2: To amend the BancFirst Corporation Stock Option Plan;

Proposal 3: To amend the BancFirst Corporation Non-Employee Directors’ Stock Option Plan;

Proposal 4: To amend the BancFirst Corporation Directors’ Deferred Stock Compensation Plan;

Proposal 5:3 To ratify the selection of BKD,FORVIS, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021;2024;

Proposal 4: To consider an advisory vote to approve the compensation of named executive officers; and

Such other business as may properly come before the meeting or any adjournments or postponements thereof.

What are the Board’s recommendations?

The Board recommends a vote:

for the election of the 2017 directors nominated by our Board and named in this proxy statement;Proxy Statement;

for the amendment of the BancFirst Corporation Stock Option Plan;

for the amendment of the BancFirst Corporation Non-Employee Directors’ Stock Option Plan;

for the amendment of the BancFirst Corporation Directors’ Deferred Stock Compensation Plan; and

for the ratification of the selection of BKD,FORVIS, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2024; and

for the approval of named executive officers compensation.

Who is entitled to vote at the Annual Meeting?

The Board set April 5, 2021March 28, 2024 as the record date for the Annual Meeting (the “record date”). You are entitled to vote if you were a shareholder of record of our common stock as of the close of business on April 5, 2021.March 28, 2024. Your shares can be voted at the Annual Meeting only if you are attending via conference call, are present in person or represented by a valid proxy.

How many votes do I have?

You will have one vote for each share of our common stock you owned at the close of business on the record date, provided those shares are either held directly in your name as the shareholder of record or were held for you as the beneficial owner through a broker, bank or other nominee. There are no voting restrictions on our common stock.

1

1

What is the difference between holding shares as a shareholder of record and beneficial owner?

Most of our shareholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record. If your shares are registered directly in your name with our transfer agent, BancFirst Trust and Investment Management, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you by the Company. As the shareholder of record, you have the right to grant your voting proxy directly to us or to vote during the conference call at the Annual Meeting. If you wish to grant a proxy, we have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or nominee, who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, sincebecause you are not the shareholder of record, you may not vote these shares during the conference call at the Annual Meeting, unless you request, complete and deliver a proxy from your broker, bank or nominee. Your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the broker, bank or nominee how to vote your shares.

What will happen if I do not vote my shares?

Shareholders of Record. If you are the shareholder of record of your shares and you do not vote by proxy card or during the conference call for the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner of your shares, your broker or nominee may vote your shares only on those proposals on which it has discretion to vote. If no voting instructions are provided, these record holders can vote your shares only on discretionary, or routine, matters and not on non-discretionary, or non-routine, matters. Uninstructed shares whose votes cannot be counted on non-routine matters result in what are commonly referred to as “broker non-votes.”

The election of directors (Proposal No. 1), the proposal to amend the BancFirst Corporation Stock Option Plan (Proposal No. 2), the proposal to amend the BancFirst Corporation Non-Employee Directors’ Stock Option Plan (Proposal No. 3) and the proposal to amend the BancFirst Corporation Directors’ Deferred Stock Compensation Plan (Proposal No. 2) and the advisory vote on executive compensation (Proposal No. 4)are considered non-routine matters under the rules and regulations promulgated by NASDAQ and approved by the Securities and Exchange Commission (“SEC”). Consequently, brokers may not vote uninstructed shares on these proposals. The ratification of BKD,FORVIS, LLP as our independent registered public accounting firm for the fiscal year ended December 31, 20212024 (Proposal No. 5)3) is considered a routine matter under the rules and regulations promulgated by NASDAQ and approved by the SEC. Consequently, brokers may vote uninstructed shares on this proposal, and we do not expect any broker non-votes on this proposal.

Abstentions and broker non-votes are counted as shares that are present for purposes of determining whether a quorum is present at the Annual Meeting. However, for purposes of determining whether a proposal is approved, abstentions and broker non-votes are tabulated separately. The effect of abstentions and broker non-votes depends on the vote required for a particular proposal. See “What vote is required to approve each proposal,” below, for a description of the effect of abstentions and broker non-votes on such proposal.

If you do not give your broker or nominee voting instructions, your broker or nominee will only be entitled to vote your shares on Proposal 5.3. We urge you to provide instructions to your broker, bank or other nominee so that your votes may be counted on all of these important matters.

How many votes can be cast by all shareholders?

Each share of BancFirst Corporation common stock is entitled to one vote. There is no cumulative voting. We had 32,771,01332,966,678 shares of common stock outstanding and entitled to vote on the record date.

How many votes must be present to hold the Annual Meeting?

A majority of our outstanding shares of common stock as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Shares that are present and entitled to vote on one or more of the matters to be voted upon at the Annual Meeting are counted as present for establishing a quorum. Both abstentions and broker non-

2

votesnon-votes are counted as present for the purpose of determining the presence of a quorum. If a quorum is not present, we expect that the Annual Meeting will be adjourned until we obtain a quorum.

2

What vote is required to approve each proposal?

Proposal 1: Election of 2017 Directors

The election of directors requires the affirmative vote of the holders of at least a majority of the common stock issued and outstanding and entitled to vote.voted for uncontested elections. Each director nominee who receives at least a majority of the common stock outstandingvoted will be elected as a director for the ensuing one year. Withheld votesHowever, if the number of nominees exceeds the number of directors to be elected (i.e. a contested election), the shareholders shall instead elect the directors by plurality vote of the shares present in person or by proxy. Abstentions will have the same effect as votes “against” this proposal, and broker non-votes will have no effect on the vote for this proposal.

Proposal 2: Amendment of the BancFirst Corporation Directors’ Deferred Stock OptionCompensation Plan

This proposal requires the affirmative vote of the holders of at least a majority of the common stock issued and outstanding and entitled to vote. AbstentionAbstentions and broker non-votes will have the same effect as a vote “against” this proposal, and broker non-votes will have no effect on the vote for this proposal.

Proposal 3: AmendmentRatification of the BancFirst Corporation Non-Employee Directors’ Stock Option Planselection of FORVIS, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024

This proposal requires the affirmative vote of the holders of at least a majority of the common stock issued and outstanding and entitled to vote. AbstentionAbstentions will have the same effect as a vote “against” this proposal.

Proposal 4: Advisory vote to approve the compensation of the named executive officers

The advisory approval of this resolution requires the affirmative vote of a majority of the shares of common stock represented via conference call, present in person or by proxy at the Annual Meeting and eligible to vote. Abstentions will have the same effect as a vote “against” this proposal, and broker non-votes will have no effect on the vote for this proposal.

Proposal 4: Amendment of the BancFirst Corporation Directors’ Deferred Stock Compensation Plan

This proposal requires the affirmative vote of the holders of at least a majority of the common stock issued and outstanding and entitled to vote. Abstention will have the same effect as a vote “against” this proposal, and broker non-votes will have no effect on the vote for this proposal.

Proposal 5: Ratification of the selection of BKD, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021

This proposal requires the affirmative vote of the holders of at least a majority of the common stock issued and outstanding and entitled to vote. Abstention will have the same effect as a vote “against” this proposal.

Can I change or revoke my vote after I return my proxy card or voting instruction card?

Yes. Even if you sign the proxy card or voting instruction card in the form accompanying this proxy statement,Proxy Statement, you retain the power to revoke your proxy or change your vote. You can revoke your proxy at any time before it is exercised by:

However, please note that if you would like to vote at the Annual Meeting and you are not the shareholder of record, you must request, complete and deliver a proxy from your broker, bank or nominee.

What does it mean if I receive more than one proxy or voting instruction card?

It generally means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Who can attend the Annual Meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend. The meeting will be held in person and via conference call. The Annual Meeting will be held at the BancFirst Tower, 34th Floor, Petroleum Club, John Nichols Room, at 100 N. Broadway

3

Ave., Oklahoma City, Oklahoma 73102. The meeting can also be accessed virtually via conference call by the following dial in number along with the accompanying access code. Dial in number: 1-408-418-9388. Access code: 2499 171 6819.

Who pays for the proxy solicitation and how will the Company solicit votes?

We will bear the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. They will not be paid any additional compensation for such solicitation. We will request brokers, banks and nominees who hold shares of our common stock in their names

3

to furnish proxy materials to beneficial owners of the shares. We will reimburse such brokers, banks and nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners.

How can I access the Company’s proxy materials and annual report electronically?

The proxy statementProxy Statement and our 20202023 Annual Report on Form 10−K are available at our proxy materials website at www.proxydocs.com/BANF. This website does not use any features that identify you as a visitor to the website. The Company’s Annual Report on Form 10-K for the year ended December 31, 20202023 (other than the exhibits thereto), as well as copies of other filings or exhibits to filings made with the SEC, are also available without charge upon written request. Such requests should be directed to: Randy Foraker, Executive Vice President and Secretary, BancFirst Corporation, 101 North100 N. Broadway Ave., Oklahoma City, Oklahoma 73102.

Is a list of shareholders available?

The names of shareholders of record entitled to vote at the Annual Meeting will be available to shareholders entitled to vote at this meeting for ten days prior to the meeting for any purpose relevant to the meeting. This list can be viewed between the hours of 9:00 a.m. and 5:00 p.m., local time, at our principal executive offices at 101100 N. Broadway Ave., Oklahoma City, Oklahoma. Please contact Randy Foraker, Executive Vice President and Secretary, BancFirst Corporation, 101 North100 N. Broadway Ave., Oklahoma City, Oklahoma 73102, to make arrangements.

How do I find out the voting results?

Preliminary voting results will be announced at the Annual Meeting, and final voting results will be published within four business days of the annual meetingAnnual Meeting on Form 8-K, which we will file with the SEC. After the Form 8-K is filed, you may obtain a copy by visiting our website at www.bancfirst.bank, which provides links to the SEC’s website. You may also obtain a copy by visiting the SEC’s website directly or by contacting Randy Foraker, Executive Vice President and Secretary, BancFirst Corporation, 101100 N. Broadway Ave., Oklahoma City, Oklahoma 73102.

What if I have questions about lost stock certificates or I need to change my mailing address?

Shareholders of record may contact our transfer agent, BancFirst Trust and Investment Management, by calling (405) 270-4797 or writing to BancFirst Trust and Investment Management, P.O. Box 26883, Oklahoma City, Oklahoma 73126, to get more information about these matters.

Your vote is important

You have the option to vote and submit your proxy over the Internet. If you have Internet access, we encourage you to record your vote over the Internet at www.proxypush.com/BANF. We believe it will be convenient for you, and it saves postage and processing costs. In addition, when you vote over the Internet, your vote is recorded immediately, and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted. If you do not vote over the Internet, please vote by telephone or by completing and returning the enclosed proxy card in the postage-paid envelope provided. Submitting your proxy over the Internet, by telephone, or by mail will not affect your right to vote in person if you decide to attend the Annual Meeting.

Vote by Mailmail

If you choose to vote by mail, simply mark your proxy card or voting instruction card, sign and date it, and return it in the postage-paid envelope provided.

4

Voting at the Annual Meeting

The method or timing of your vote will not limit your right to vote at the Annual Meeting if you attend the meeting and vote via the conference call.vote. However, if your shares are held in the name of a broker, bank or other nominee, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record, and send to the Secretary of the Company at least five business days before the meeting.

4

The shares represented by the proxy cards or voting instruction cards received, properly marked, signed, dated and not revoked, will be voted at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy card will be voted as recommended by the Board. If you fail to return your proxy card, or if your shares are held in “street name” and you do not instruct your broker how to vote your shares by failing to complete the voting instruction card, the effect will be as though you cast a vote “against” Proposals 1, 2, 3 and 4.

ELECTION OF 2017 DIRECTORS

Our Board currently consists of 2117 members. At the recommendation of the Independent Directors’ Committee, the Board has nominated 2017 director nominees identified in this Proposal 1 to serve a one-year term, until the 20222025 Annual Meeting of Shareholders and until their successors are duly elected and qualified, or until their earlier resignation or removal. For additional information about the director nominees and their qualifications, see “Corporate Governance—Directors of BancFirst Corporation.” The nominees for the election of directors at the Annual Meeting are as follows:

Name |

| Age |

|

| Occupation |

|

| Year First Elected Director |

|

| Age |

| Occupation |

| Year First Elected Director | |

Dennis L. Brand |

|

| 73 |

|

| Vice Chairman, BancFirst Corporation |

|

| 2000 |

| ||||||

C.L. Craig, Jr. |

|

| 76 |

|

| Private Investor |

|

| 1998 |

| ||||||

F. Ford Drummond |

|

| 58 |

|

| Owner/Operator, Drummond Ranch |

|

| 2011 |

|

| 61 |

| Owner/Operator, Drummond Ranch |

| 2011 |

Joseph Ford |

|

| 43 |

|

| President, Shawnee Milling Company |

|

| 2017 |

|

| 46 |

| President, Shawnee Milling Company |

| 2017 |

Joe R. Goyne |

|

| 75 |

|

| Chairman and Chief Executive Officer, Pegasus |

|

| 2019 |

|

| 78 |

| Chairman, Pegasus |

| 2019 |

David R. Harlow |

|

| 58 |

|

| Chief Executive Officer, BancFirst Corporation |

|

| 2017 |

|

| 61 |

| Chief Executive Officer, BancFirst Corporation |

| 2017 |

William O. Johnstone |

|

| 73 |

|

| Vice Chairman, BancFirst Corporation and President, Council Oak Partners |

|

| 1996 |

| ||||||

Frank Keating |

|

| 77 |

|

| President, Frank Keating Investments |

| 2016 |

| |||||||

Mautra Staley Jones |

| 45 |

| President, Oklahoma City Community College |

| 2021 | ||||||||||

Bill G. Lance |

|

| 56 |

|

| Secretary of Commerce, Chickasaw Nation |

| 2018 |

|

| 59 |

| Secretary of State, Chickasaw Nation |

| 2018 | |

Dave R. Lopez |

|

| 69 |

|

| Manager of DL Dynamics, LLC |

|

| 2013† |

|

| 72 |

| Controlling Manager of DL Dynamics, LLC |

| 2013† |

William Scott Martin |

|

| 71 |

|

| Private Investor |

|

| 2018 |

|

| 74 |

| Private Investor |

| 2018 |

Tom H. McCasland, III |

|

| 62 |

|

| President, Mack Energy Co. |

|

| 2005 |

|

| 65 |

| President, Mack Energy Co. |

| 2005 |

David E. Rainbolt |

|

| 65 |

|

| Executive Chairman, BancFirst Corporation and BancFirst |

|

| 1984 |

|

| 68 |

| Executive Chairman, BancFirst Corporation and BancFirst |

| 1984 |

H.E. Rainbolt |

|

| 92 |

|

| Chairman Emeritus, BancFirst Corporation |

|

| 1984 |

| ||||||

Dr. Leslie J. Rainbolt |

| 66 |

| Private Investor |

| 2023 | ||||||||||

Robin Roberson |

|

| 49 |

|

| Managing Director, North America for Claim Central Consolidated |

|

| 2017 |

|

| 52 |

| Senior Vice President, Eberl Claims Service |

| 2017 |

Darryl W. Schmidt |

|

| 58 |

|

| Chief Executive Officer, BancFirst |

|

| 2017 |

|

| 61 |

| Chief Executive Officer, BancFirst |

| 2017 |

Natalie Shirley |

|

| 63 |

|

| President and Chief Executive Officer, National Cowboy and Western Heritage Museum |

|

| 2013 |

|

| 66 |

| Regent, University of Oklahoma |

| 2013 |

Michael K. Wallace |

|

| 67 |

|

| President, Wallace Properties, Inc. and Mike Wallace Homes |

|

| 2007 |

|

| 70 |

| President, Wallace Properties, Inc. and Mike Wallace Homes |

| 2007 |

Gregory G. Wedel |

|

| 60 |

|

| Managing Partner, Wedel, Rahill and Associates, CPA’s |

|

| 2014 |

|

| 63 |

| Managing Partner, Wedel, Rahill and Associates, CPA’s |

| 2014 |

G. Rainey Williams, Jr. |

|

| 60 |

|

| President, Marco Holding Corporation |

|

| 2003 |

|

| 63 |

| President, Marco Holding Corporation |

| 2003 |

|

|

|

|

| ||||||||||||

† Mr. Lopez previously served as a director of the Company from 2005-2011. | † Mr. Lopez previously served as a director of the Company from 2005-2011. |

|

| |||||||||||||

|

|

Unless otherwise specified in the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election of these nominees as directors of the Company. The nominees have agreed to stand for election and, if elected, to serve as directors. However, if any person nominated by the Board is unable or unwilling to serve, the proxies will be voted for the election of such other person or persons as the Independent Directors’ Committee and the Board may recommend.

The sections in this proxy statementProxy Statement titled “Corporate Governance—Directors of BancFirst Corporation” and “—Stock Ownership”“Stock Ownership—Directors and Officers” provide certain information about each nominee based on data submitted by such persons, including the principal occupation of such person for at least the last five years and any public company directorships held by such person.

The Board unanimously recommends a vote “FOR” the election of the nominees to the Board. Proxies solicited by the Board will be voted for each of the nominees unless instructions to withhold or to the contrary are given.

5

5

PROPOSAL 2

APPROVAL OF AMENDMENT TO THE BANCFIRST CORPORATION STOCK OPTION PLAN

Subject to shareholder approval, the Board has amended the BancFirst Corporation Stock Option Plan (the “Employee Plan”) to increase the remaining number of shares of common stock authorized to be granted after the date of such amendment to 300,000 shares. As of April 5, 2021, there were 167,500 shares of common stock available for future option grants under the Employee Plan.

The Board believes that the approval of the amendment to the Employee Plan is in the best interests of the Company and its shareholders, as the availability of an adequate number of shares reserved for issuance under the Employee Plan and the ability to grant stock options is an important factor in attracting, motivating and retaining qualified personnel essential to the success of the Company.

Summary of the Provisions of the Employee Plan

The principal features of the Employee Plan are summarized below. This summary does not purport to be a complete description of all the provisions of the Employee Plan. The summary is qualified in its entirety by the full text of the Employee Plan, as proposed to be amended by the BancFirst Corporation resolution to amend the stock option plan. The resolution has been filed as Appendix A to the copy of this Proxy Statement that was filed electronically with the SEC and can be reviewed on the SEC’s website at www.sec.gov. A copy of the plan document may also be obtained without charge by writing to Randy Foraker, Executive Vice President and Secretary at BancFirst Corporation, 101 N. Broadway, Oklahoma City, Oklahoma 73102.

The Employee Plan, which is not subject to the provisions of the Employee Retirement Income Security Act of 1974, provides for the grant of non-qualified stock options.

The Employee Plan is administered by the Committee. The Committee is generally the Board, certain members of which are principal shareholders and employees of the Company or its affiliates, and the Board may also include participants in the Employee Plan. Pursuant to the Employee Plan, the Executive Committee of the Board may, by delegation of the Board, function as the Committee.

All decisions of the interpretation or application of the Plan are determined by the Committee and such decisions are final, conclusive and binding on all participants.

The maximum number of shares of common stock that may be granted pursuant to the Employee Plan is proposed to be increased from 167,500 to 300,000 shares (subject to adjustment in the event of stock dividends, stock splits, reverse stock splits, combinations, reclassifications, or like changes in the capital structure of the Company).

Currently all plan options must be granted, if at all, no later than December 31, 2024.

Options may be granted only to employees (including officers) of the Company or its subsidiaries. All plan options must have an exercise price equal to the fair market value of the common stock on the date of grant. As defined in the Employee Plan, “fair market value” is stated to be equal to the closing price of the common stock as reported on the NASDAQ Global Market, Inc. (“NASDAQ”) on the date of grant or, if no closing price is so reported, the closing price of the common stock as reported by NASDAQ on the most recent date next preceding the date of grant.

The exercise price is payable on exercise of the plan option and is payable in cash, certified check, bank draft or money order, unless otherwise determined by the Board. Unless otherwise determined by the Board at the time of granting an option, plan options vest 25% per year commencing on the fourth year after grant, until the Plan Option is 100% vested. Except for termination of employment as a result of retirement or death, if an optionee ceases to be an employee of the Company for any reason, other than as a result of embezzlement, theft or other violation of law, the optionee may exercise his or her option (to the extent exercisable at the time of termination) at any time within 30 days after termination. If an optionee ceases to be an employee of the Company due to retirement, the optionee may exercise the option (to the extent exercisable at the time of termination) at any time within six months after such retirement. If an optionee ceases to be an employee of the Company due to death, the optionee’s estate, personal representative, or beneficiary shall have the right to exercise the option (to the extent exercisable at the time of death) at any time within 12 months from the date of the optionee’s death.

During the lifetime of the optionee, an option may be exercised only by the optionee. Unless otherwise provided by the Committee, no option may be assignable except (i) by will, (ii) by the laws of descent and distribution, (iii) for the purpose of making a charitable gift, or (iv) to a revocable trust of which the optionee is a trustee.

Except as described above, plan options may not have a term in excess of 15 years.

6

The Board may terminate or amend the Employee Plan at any time; provided, however, that without the approval of the shareholders of the Company, the Board may not amend the Employee Plan to materially increase the total number of shares of common stock covered thereby, materially increase the benefits accruing to participants under the Employee Plan, or materially modify the requirements as to eligibility for participation in the Employee Plan.

Summary of Federal Income Tax Consequences of the Employee Plan

The federal tax consequences of stock options are complex and subject to change. Furthermore, the following summary is intended only as a general guide to the United States federal income tax consequences of options granted under the Employee Plan under current law, and does not attempt to describe all potential tax consequences. In particular, this summary does not describe the deferred compensation provisions of Section 409A of the Internal Revenue Code to the extent that an award is subject to such provision.

Non-qualified stock options have no special tax status. An optionee generally recognizes no taxable income as the result of the grant of such an option. Upon exercise of the option, the optionee normally recognizes ordinary income with respect to the acquired shares in the amount of the difference between the option price and the fair market value of the shares on the date of exercise. Such ordinary income generally is subject to withholding of income and employment taxes. Upon the sale of stock acquired by the exercise of a non-qualified stock option, any gain or loss, based on the difference between the sale price and the fair market value of the shares on the date of recognition of income, will be taxed as long-term or short-term capital gain or loss, depending upon the length of time the optionee has held the stock from the date of recognition of income. No tax deduction is available to the Company with respect to the grant of the option or the sale of stock acquired pursuant to such grant. Provided certain withholding requirements are met, the Company should be entitled to a deduction equal to the amount of ordinary income recognized by the optionee as a result of the exercise of the option.

Specific Benefits under the Employee Plan

The Company has not approved any awards that are conditioned upon shareholder approval of the proposed amendment of the Employee Plan. The number, amount and type of awards to be received by or allocated to eligible persons in the future under the Employee Plan cannot be determined at this time.

For information regarding stock-based awards granted to the Named Executive Officers during fiscal 2020, see the material under the heading “Executive Compensation” below in this proxy statement. For information regarding past award grants under the Employee Plan, see the “Aggregate Past Grants under the Employee Plan” table below.

Aggregate Past Grants under the Employee Plan

As of April 5, 2021, awards covering 7,732,512 shares (before cancellations of awards covering 1,316,982 shares) of the Company’s common stock had been granted under the Employee Plan. The following table shows information regarding the distribution of those awards among the persons and groups identified below, as well as shares subject to unexercised options outstanding as of that date.

Aggregate Past Grants Under the Employee Plan | ||

Name |

Total Shares Subject to Previous Option Grants(1) |

Shares Subject to Unexercised Options Outstanding |

Named Executive Officers: |

|

|

David R. Harlow Chief Executive Officer | 185,000 | 65,000 |

Kevin Lawrence Executive Vice President and Chief Financial Officer | 100,000 | 83,000 |

David E. Rainbolt Executive Chairman | 120,000 | — |

Dennis L. Brand Chairman of the Executive Committee | 220,000 | — |

Darryl W. Schmidt President and Chief Executive Officer, BancFirst | 185,000 | 65,000 |

All Executive Officers as a Group | 2,202,500 | 417,000 |

Non-Executive Officer Employee Group | 4,213,030 | 615,250 |

(1) Does not include cancellations of awards covering 1,316,982 shares.

The Board recommends a vote “FOR” the proposed amendment to the BancFirst Corporation Stock Option Plan.

7

PROPOSAL 3

APPROVAL OF AMENDMENT TO THE BANCFIRST CORPORATION

NON-EMPLOYEE DIRECTORS’ STOCK OPTION PLAN

Subject to shareholder approval, the Board has amended the BancFirst Corporation Non-Employee Directors’ Stock Option Plan (the “Non-Employee Directors’ Plan”) to increase the remaining number of shares of common stock authorized to be granted after the date of such amendment to 50,000 shares. As of April 5, 2021, there were 30,000 shares available for issuance under the Non-Employee Directors’ Plan.

The Non-Employee Directors’ Plan was approved by the Company’s shareholders on June 24, 1999. The purpose of the Non-Employee Directors’ Plan is to compensate non-management directors for participation on the Board or its committees by the automatic grant of stock options to purchase shares of the Company’s common stock. Directors who are employees of BancFirst Corporation are not eligible to participate in the Non-Employee Directors’ Plan.

Summary of the Provisions of the Non-Employee Directors’ Plan

Following is a brief description of the principal features of the Non-Employee Directors’ Plan. The summary is qualified in its entirety by reference to the full text of the Non-Employee Directors’ Plan, as proposed to be amended by the BancFirst Corporation resolution to amend the Non-Employee Directors’ Stock Option Plan. The resolution has been filed as Appendix B to the copy of this Proxy Statement that was filed electronically with the SEC and can be reviewed on the SEC’s website at www.sec.gov. A copy of the plan document may also be obtained without charge by writing the Randy Foraker, Executive Vice President and Secretary at BancFirst Corporation, 101 N. Broadway, Oklahoma City, Oklahoma 73102.

Directors who are not employees of the Company are eligible to participate in the Non-Employee Directors’ Plan. The Non-Employee Directors’ Plan is administered by our Board. All questions of interpretation of the Non-Employee Directors’ Plan or of the options granted pursuant to the Non-Employee Directors’ Plan are determined by the Board. However, the grants of stock options and the amount and nature of the options granted are automatic, as described below.

Under the Non-Employee Directors’ Plan, an option to purchase 10,000 shares of common stock is granted to each non-employee director upon initial appointment to the Board. The exercise price for an option is determined by the closing price as reported on the NASDAQ Global Market (or other principal exchange on which the common stock is traded) on the business day preceding the date the option is granted.

An option becomes exercisable in four equal annual installments beginning on the first anniversary of the date of grant, and expires on the fifteenth anniversary of the date of grant. If a director is terminated for cause, all options will be forfeited immediately. If a director ceases to be member of the Board for any other reason, unvested options will terminate and only previously vested options may be exercised for a period of 30 days following termination. If an optionee ceases to be a director due to death, the optionee’s estate, personal representative, or beneficiary shall have the right to exercise the option (to the extent exercisable at the time of death) at any time within 12 months from the date of the optionee’s death).

The exercise price of an option granted under the Non-Employee Directors’ Plan must be paid upon exercise of the option and is payable in cash, certified check, bank draft or money order, unless otherwise determined by the Board. Stock options granted under the Non-Employee Directors’ Plan are non-qualified stock options.

If the amendment to the Non-Employee Directors’ Plan is approved by our shareholders, the remaining number of shares of common stock that are reserved for issuance under the Non-Employee Directors’ Plan will be increased to 50,000 shares, (subject to adjustment in the event of stock dividends, stock splits, reverse stock splits, combinations, reclassifications, or like changes in the capital structure of the Company). Options and shares that are forfeited or otherwise reacquired by us will again be available for the grant of options under the Non-Employee Directors’ Plan. Shares of common stock issued under the Non-Employee Directors’ Plan may be authorized but unissued shares or shares reacquired by us and held in treasury.

The Board may terminate or amend the Non-Employee Directors’ Plan at any time; provided, however, that without the approval of the shareholders of the Company, the Board may not amend the Non-Employee Directors’ Plan to materially increase the total number of shares of common stock covered thereby, materially increase the benefits accruing to participants under the plan, or materially modify the requirements as to eligibility for participation in the plan.

Summary of Federal Income Tax Consequences of the Non-Employee Directors’ Plan

The following is a general description of federal income tax consequences to our non-employee directors relating to stock options granted under the Non-Employee Directors’ Plan. This discussion does not purport to cover all federal tax consequences relating to the

8

directors or the Company, nor does it describe state, local or foreign tax consequences. In particular, this summary does not describe the deferred compensation provisions of Section 409A of the Internal Revenue Code to the extent that an award is subject to such provision.

A director will not recognize income upon the grant of a non-qualified stock option to purchase shares of common stock. Upon exercise of the option, the director will recognize ordinary compensation income equal to the excess of the fair market value over the exercise price for such shares. We will be entitled to a tax deduction equal to the amount of ordinary compensation income recognized by the director. The deduction will be allowed at the same time the director recognizes the income. The tax basis of the shares of common stock in the hands of the director will equal the exercise price paid for the shares plus the amount of ordinary compensation income the director recognizes upon exercise of the option, and the holding period for the shares for capital gains purposes will commence on the day the option is exercised. A director who sells shares of common stock acquired on exercise of the option will recognize capital gain or loss measured by the difference between the tax basis of the shares and the amount realized on the sale.

Specific Benefits under the Non-Employee Directors’ Plan

Awards under the Non-Employee Directors’ Plan are automatic to each non-employee director upon initial appointment to the Board, and the Company has not approved any awards that are conditioned upon shareholder approval of the proposed amendment of the Non-Employee Directors’ Plan.

Aggregate Past Grants under the Non-Employee Directors’ Plan

As of April 5, 2021, awards covering 535,000 shares issuable under the Non-Employee Directors’ Plan had been granted (before cancellations of awards covering 20,000 shares), with the current non-employee directors of the Company as a group having been granted options to purchase an aggregate 260,000 shares of common stock.

The Board recommends a vote “FOR” the proposed amendment to the BancFirst Corporation Non-Employee Directors’ Stock Option Plan.

APPROVAL OF AMENDMENT TO THE BANCFIRST CORPORATION

Directors’ Deferred Stock Compensation Plan

Subject to shareholder approval, the Board has amended the BancFirst Corporation Directors’ Deferred Stock Compensation Plan (the “Deferred Stock Compensation Plan”) to increase the aggregate remaining number of shares available for authorization under the Deferred Stock Compensation Plan to 40,000 shares of common stock.stock, and to extend the term of the Deferred Stock Compensation Plan from December 31, 2024 to December 31, 2030. As of April 5, 2021,March 28, 2024, there were only approximately 19,40915,923 shares available for authorization under the Deferred Stock Compensation Plan.

The Deferred Stock Compensation Plan is intended to provide individuals who serve as directors of the Company or its banking subsidiary,subsidiaries, BancFirst, Pegasus or Worthington, or as advisory directors of the various community bank branches of BancFirst (each, a “Participating Director” and collectively, “Participating Directors”), an opportunity to defer the receipt of their director fees and to receive those deferred fees in the form of shares of common stock. All of the Company’s directors are eligible to participate in the Deferred Stock Compensation Plan.

Summary of the Provisions of the Deferred Stock Compensation Plan

The principal features of the Deferred Stock Compensation Plan are summarized below. This summary does not purport to be a complete description of all the provisions of the Deferred Stock Compensation Plan.Plan. The summary is qualified in its entirety by the full text of the Deferred Stock Compensation Plan, as it is proposed to be amended by the BancFirst Corporation resolution to amend the Deferred Stock Compensation Plan. The resolution has been filed as Appendix CA to the copy of this Proxy Statement that was filed electronically with the SEC and can be reviewed on the SEC’s website at www.sec.gov. A copy of the planDeferred Stock Compensation Plan document may also be obtained without charge by writing to Randy Foraker, Executive Vice President and Secretary at BancFirst Corporation, 101100 N. Broadway, Oklahoma City, Oklahoma 73102.

Under the Deferred Stock Compensation Plan, Participating Directors may defer all or part of their director fees otherwise payable in cash. Compensation that is deferred will be credited to each Participating Director’s account under the Deferred Stock Compensation Plan (the “Deferral Account”) in the form of Units. The number of Units credited will be determined by dividing the amount of fees deferred by the closing price of the common stock on the deferral date as reported in The Wall Street Journal or a similar publication selected by the Compensation Committee. When cash dividends are paid on common stock, the Participating Director’s Deferral Account will be credited with a number of Units determined by multiplying the number of Units in the Deferral Account on the dividend record date by the per-share dividend amount and then dividing the product by the stock price on the dividend record date. In the case

9

of stock dividends, the Participating Director’s Deferral Account will be credited with a number of Units determined by multiplying the number of Units in the Deferral Account by the stock dividend declared.

Following the earlier of (i) a Participating Director’s termination of service as a director or in the event of a Participating Director’s death, or (ii) the termination date of the Deferred Stock Compensation Plan, all amounts credited to a Participating Director’s Deferral Account will be paid to the Participating Director in the form of shares of common stock, the number of which shares will equal the number of Units credited to the Participating Director’s Deferral Account. A Participating Director may elect to receive the shares in a lump sum on a date specified by the Participating Director or in substantially equal annual installments over a period not to exceed three years.

The Deferred Stock Compensation Plan is administered by the Compensation Committee of the Board, certain members of which may also include participants in the Employee Plan.Board. The Deferred Stock Compensation Plan may be amended or terminated at any time by the Compensation Committee.

Summary of Federal Income Tax Consequences of the Deferred Stock Compensation Plan

The following is a general description of federal income tax consequences to our non-employee directors relating to the Deferred Stock Compensation Plan. This discussion does not purport to cover all federal tax consequences relating to the directors or the Company, nor does it describe state, local or foreign tax consequences. In particular, this summary does not describe the deferred compensation provisions of Section 409A of the Internal Revenue Code to the extent that an award is subject to such provision.

The Deferred Stock Compensation Plan permits Participating Directors to defer to a later year receipt of all or a portion of their director fees that otherwise would be includible in income for tax purposes in the year in which it would have been paid. Under current tax laws, no income will be recognized by a Participating Director at the time of deferral. Upon payment, a Participating Director will recognize ordinary income in an amount equal to the sum of the fair market value of the shares of common stock received and the cash received for any fractional share. The Company will be entitled to a deduction equal to the income recognized by the Participating Director.

6

Specific Benefits under the Deferred Stock Compensation Plan

The number of persons participating in the Deferred Stock Compensation Plan is 85.76. Because the aggregate benefits under the Deferred Stock Compensation Plan are dependent upon the number of Participating Directors who elect to participate in the Deferred Stock Compensation Plan, the portion of their directors’ fees that Participating Directors elect to defer and the market price of common stock when deferred compensation and dividends are credited to their Deferral Accounts, it is not possible to predict what benefits will be received under the Deferred Stock Compensation Plan.

Aggregate Past Grants under the Deferred Stock Compensation Plan

The following table shows information regarding the number of Units credited to Participating Directors’ Deferral Accounts in respect of deferral of directors’ fees under the Deferred Stock Compensation Plan as of April 5, 2021.March 28, 2024.

Aggregate Past Grants Under the Deferred Stock Compensation Plan | ||||

| Total Number of Units Credited | |||

| — | |||

|

| — | ||

|

| — | ||

David E. Rainbolt

|

| — | ||

|

| — | ||

|

| |||

All Executive Officers as a Group |

| 384 | ||

Non-Executive Director Group |

| 60,923 | ||

Non-Executive Officer Employee Group |

| — | ||

The Board recommends a vote “FOR” the proposed amendment to the BancFirst Corporation Directors’ Deferred Stock Compensation Plan.

10

PROPOSAL 53

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BKD,FORVIS, LLP (“BKD”("FORVIS") was the Company’s independent registered public accounting firm for fiscal year 20202023 and has been approved by the Audit Committee of the Board (the “Audit Committee”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.2024. Although ratification is not required by the Company’s certificate of incorporation, bylaws, Oklahoma law or otherwise, the Board is submitting the appointment of BKDFORVIS to the Company’s shareholders for ratification because the Company values its shareholders’ views on the independent registered public accounting firm. If the Company’s shareholders fail to ratify the appointment, it will be considered as a non-binding recommendation to the Board and the Audit Committee to consider the appointment of a different firm for fiscal year 2021.2024. Even if the appointment is ratified, the Board and the Audit Committee may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Representatives of BKDFORVIS are expected to attend the Annual Meeting and will have an opportunity to make a statement or to respond to appropriate questions from shareholders. BKDFORVIS has advised the Company that they are independent with respect to the Company.

Pre-Approval Policies and Procedures

The Audit Committee has established a policy to pre-approve all audit services and non-audit services performed by our independent registered public accounting firm. The Audit Committee also considers whether such services are consistent with the SEC’s rules on auditor independence and considers whether our independent registered public accounting firm is positioned to provide us with effective and efficient audit services needed to properly manage risk or improve audit quality. In its review of any non-audit service fees, the Audit Committee considers, among other things, the possible effect of the performance of such services on the auditor’s independence. No non-audit services were performed for the Company by BKDFORVIS during 20202023 or 2019.2022. The Audit Committee pre-approved 100% of audit fees and audit-related fees during the year ended December 31, 2020.2023.

7

The following table shows the fees billed for the audit provided by BKDFORVIS during the years ended December 31, 20202023 and 2019.2022.

|

| 2020 |

|

| 2019 |

|

| 2023 |

|

| 2022 |

| ||||

Audit fees |

| $ | 764,352 |

|

| $ | 726,819 |

|

| $ | 879,128 |

|

| $ | 782,896 |

|

Audit-related fees |

| — |

|

| — |

|

|

| — |

|

|

| — |

| ||

Tax fees |

| — |

|

| — |

|

|

| — |

|

|

| — |

| ||

All other fees |

| — |

|

| — |

|

|

| — |

|

|

| — |

| ||

Total |

| $ | 764,352 |

|

| $ | 726,819 |

|

| $ | 879,128 |

|

| $ | 782,896 |

|

Audit fees for professional services rendered by BKDFORVIS include fees related to the audits of the Company and of certain of our subsidiaries, other attestation services, internal control audits and assistance with interpretation of accounting standards.

Additional information concerning the Audit Committee and its activities with BKDFORVIS can be found in the following sections of this proxy statement:Proxy Statement: “Corporate Governance—Audit Committee” and “Audit Committee Report.”

The Board recommends a vote “FOR” the ratification of the appointment of BKDFORVIS as the independent registered public accounting firm of the Company for 2021.2024. Proxies solicited by the Board will be voted for the proposal unless contrary instructions are given.

PROPOSAL 4

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

The Company is providing the shareholders the opportunity for an advisory vote on the compensation of named executive officers as required by section 14A of the Securities Exchange Act of 1934 (the "Exchange Act"). Section 14A was added to the Exchange Act by Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). Shareholders can vote, on an advisory basis, to approve, not less frequently than once every three years, the compensation of the Company’s named executive officers disclosed in the Proxy Statement. This vote is known as “Say-on-Pay”.

The Company is asking shareholders to vote, in an advisory manner, to approve the executive compensation philosophy, policies and procedures described in the Compensation Discussion and Analysis section of this Proxy Statement and the compensation of the Company’s Named Executive Officers, as disclosed in this Proxy Statement.

Because this vote is advisory, it will not be binding on the Compensation Committee, the Board, or the Company. However, the Compensation Committee and the Board value the opinions of the Company’s shareholders, and the Compensation Committee will consider the outcome of the vote in its establishment and oversight of the compensation of the named executive officers.

The Board recommends a vote “FOR” the approval of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement.

8

CORPORATE GOVERNANCE

The Company complies with all federal laws affecting corporate governance and disclosures, such as the Sarbanes-Oxley Act of 2002 and rules adopted by the SEC and NASDAQ, as well as various governance best practices.

The NASDAQ’s listing standards require our Board to be comprised of at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company. Based on the independence standards prescribed by NASDAQ, our Board has affirmatively determined that each of the following directors is independent: C. L. Craig, Jr., F. Ford Drummond, Joseph Ford, Frank Keating,Mautra Staley Jones, Bill G. Lance, Dave R. Lopez, William Scott Martin, Tom H. McCasland, III, Ronald J. Norick, Robin Roberson, Natalie Shirley, Michael K. Wallace, Gregory G. Wedel and G. Rainey Williams, Jr. In addition, as prescribed by the NASDAQ Marketplace Rules, these independent directors have at least one scheduled meeting without management present. See “Corporate Governance—Independent Directors’ Committee.”

11

In determining independence, the Board reviews whether directors have any material relationship with the Company. The Board considers all relevant facts and circumstances. In assessing the materiality of a director’s relationship to the Company, the Board considers the issues from the director’s standpoint and from the perspective of the persons or organizations with which the director has an affiliation and is guided by the standards set forth below. The Board reviews commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. An independent director must not have any material relationship with the Company, directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, or any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

A director will not be considered independent in the following circumstances:

|

|

|

|

|

|

|

|

|

|

(1) The director is, or has been in the past three years, an employee of the Company, or an immediate family member of the director is, or has been in the past three years, an executive officer of the Company.

(2) The director has received, or has an immediate family member who has received during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company, other than compensation for Board service, compensation received by the director’s immediate family member for service as a non-executive employee of the Company, and pension or other forms of deferred compensation for prior service with the Company that is not contingent on continued service.

(3) (A) The director or an immediate family member is a current partner of the firm that is the Company’s external auditor; (B) the director is a current employee of such a firm; (C) the director has an immediate family member who is a current employee of such a firm and who participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice; or (D) the director or an immediate family member is or was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on the Company’s audit within that time.

(4) The director or an immediate family member is, or has been in the past three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or has served on that company’s compensation committee.

(5) The director is, or has an immediate family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed the greater of 5% of the recipient’s consolidated gross revenues for that year, or $200,000.

For these purposes, an “immediate family member” includes a director’s spouse, parents, children, siblings, mother-and father-in-law, sons-and daughters-in-law, brothers-and sisters-in-law, and anyone who shares the director’s home.

Board Refreshment and Assessment

Effective Board refreshment and assessment processes are an integral part of corporate governance. No person can be nominatedis eligible to stand for election as a director after attainingif they have attained the age of 79 years old, so there is an ongoing needold. As a result, we expect the size of the Board to identify and consider new director candidates.be reduced in number due to normal retirements. The Board Issues Committee is responsible for identifying director candidates, assessing the skills and performance of continuing directors, and recommending candidates for nomination to the Independent Directors Committee for their consideration as directors for the annual election and filling any Board vacancies.

9

Director Qualifications

The Company has no specified Board membership criteria that apply to nominees recommended for a position on the Company’s Board. However, members of the Board should have the highest professional and personal ethics and values, consistent with the Company’s longstanding values and standards. They should also have broad experience at the policy-making level in business, government, education, technology or public service. In addition, directors should represent a diversity of viewpoints, backgrounds, experiences, gender and other demographics. They should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Directors’ service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties.

Identifying and Evaluating Candidates for Directors

Candidates may come to the attention of the Board Issues Committee through current Board members, shareholders or other persons. Identified candidates may be considered at any point during the year. As described below, the Independent Directors’ Committee will consider properly submitted shareholder recommendations for candidates for the Board to be included in the Company’s proxy statement.Proxy Statement. In making its nominations, the Independent Directors’ Committee seeks to achieve a diversity of backgrounds, experience, skill-sets, ethnicity and gender on the Board.

12

Shareholder Recommendations

The policy of the Independent Directors’ Committee is to consider properly submitted shareholder recommendations of candidates for membership on the Board as described above under “Identifying and Evaluating Candidates for Directors.” In evaluating any such recommendations, the Independent Directors’ Committee will consider the balance of knowledge, experience and capability on the Board and will address the membership criteria set forth above under “Director Qualifications.” Any shareholder recommendations proposed for consideration by the Independent Directors’ Committee should include the candidate’s name and qualifications for Board membership and should be addressed to the Secretary pursuant to the procedure described under the heading “Proposals for the 20222025 Annual Meeting of Shareholders.”

Skillset of Director Nominees

The Company believes the following skills should be represented in its Board of Directors to help ensure the success of the Company.

• Accounting/Finance | • Government Affairs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

To ensure that the Board has an appropriate mix of skills and experiences, the Board Issues Committee has prepared and evaluated the skill matrix below for the directors nominated for election. The skills listed were limited to three top skills for each director.

|

| |||||||||

|

|

|

| |||||||

|

|

|

| |||||||

|

|

| Agriculture | |||||||

|

|

|

| |||||||

| Accounting/Finance |

| Corporate Governance | |||||||

|

|

|

| |||||||

|

|

|

| |||||||

|

|

|

| |||||||

|

|

|

| |||||||

|

|

|

| |||||||

|

|

|

| |||||||

Tom H. McCasland, III | Energy | Investments | Entrepreneurship/Small Business | |||||||

David E. Rainbolt | Accounting/Finance | Government Affairs | Corporate Governance | |||||||

|

| Education | Public Relations/Marketing |

| ||||||

Robin Roberson | Entrepreneurship/Small Business | Technology | Public Relations/Marketing | |||||||

Darryl W. Schmidt | Accounting/Finance | Agriculture | Corporate Governance | |||||||

Natalie Shirley |

|

|

| |||||||

Michael K. Wallace | Entrepreneurship/Small Business | Public Relations/Marketing | Real Estate | |||||||

Gregory G. Wedel | Accounting/Finance |

| Real Estate | |||||||

G. Rainey Williams, Jr. | Investments | Law | Real Estate | |||||||

Board Diversity

The diversity of the Company’s Board of Directors exceeds the Diversity Objective as stated in the Corporate Governance Requirements of the NASDAQ Listing Rules.

Although the Company has not adopted a formal policy, a Board consisting of individuals with diverse backgrounds ensures broader representation and deeper commitment to the Company’s employees and communities. Currently, 41% of our Board nominees are diverse from a gender, race or ethnic perspective. For additional information regarding the composition of our Board nominees, including diversity, see the Board Diversity Matrix below. The Board is committed to ensuring that it remains composed of directors who are equipped to oversee the success of the Company, striving to maintain an appropriate balance of diversity, skills, and tenure in its composition, and intends to increase its gender diversity over the next few years. Principally, this will occur through a reduction in the size of the Board due to normal retirements.

|

|

|

|

|

Board Diversity Matrix | ||||

Total Number of Director Nominees |

| 17 | ||

|

| Female |

| Male |

Part I: Gender Identity |

|

|

|

|

Directors |

| 4 |

| 13 |

Part II: Demographic Background |

|

|

|

|

African American or Black |

| 1 |

| 0 |

White |

| 3 |

| 10 |

Alaskan Native or Native American |

| 0 |

| 2 |

Hispanic or Latino |

| 0 |

| 1 |

11

13Board Assessment Process

The Company’s Board developed and completed an assessment process in early 2022 that was led by the Board Issues Committee. The objectives of the assessment were to:

The assessment process was based on a written survey including both whole board and director self-evaluations that was completed by all of the directors. The Board Issues Committee reviewed the results of the survey and comments received, and reported the results to the full Board in its February 2022 meeting. The Board Issues Committee then considered the survey results, including the director self-evaluations, in making its recommendation to the Independent Directors Committee for the director candidates to be considered for nomination for election. It is intended that the board assessment process will be conducted every two years. The next assessment is planned to be completed before the 2024 Annual Meeting of Shareholders.

Directors of BancFirst Corporation

The following information about each nominee for director to our Board includes their business experience, director positions held currently or at any time during the last five years, and the experiences, qualifications, attributes or skills that caused the Independent Directors’ Committee and our Board to determine that each individual should serve as one of our directors. The following information is current as of April 5, 2021:March 28, 2024:

Name (Age) | Business Experience During Past 5 Years and Other Information | |

|

| |

|

| |

F. Ford Drummond | Mr. Drummond is currently the Owner/Operator of Drummond Ranch in Pawhuska, Oklahoma. He served as General Counsel for BMI-Health Plans from 1998 to 2008. He has served on the Board of Trustees for Allianz Funds in New York since 2005. He was also a member of the Oklahoma Water Resources Board, an Oklahoma state government regulatory board, from 2006 to 2017. In addition, he was a director of The Cleveland Bank in Cleveland, Oklahoma, from 1998 to 2012. Mr. Drummond’s business experience, together with his | |

Joseph Ford

(46) | Mr. Ford has served as the President of Shawnee Milling Company, a family-owned milling company, since 2016. He was the Vice President of Operations of Shawnee Milling Company from 2005 to 2009, and then was the Senior Vice President of Operations from 2009 to 2016. From 2000 to 2003, Mr. Ford was an Information Consultant for Accenture Information Technology Consulting. He is also involved in a broad array of civic and community affairs. Mr. Ford’s business and management experience and his knowledge and awareness of the communities we serve, makes him well qualified to serve as a board director. | |

Joe R. Goyne (78) | Mr. Goyne is currently the Chairman Mr. Goyne’s executive management experience in banking, along with his knowledge and awareness of the Dallas market, make him well qualified to serve as a board director. | |

12

14

David R. Harlow | Mr. Harlow became Chief Executive Officer of BancFirst Corporation in May 2017. Mr. Harlow joined the Company in 1999 as Executive Vice President and Manager of Commercial Banking for BancFirst Oklahoma City. He was President of BancFirst Oklahoma City from 2003 to 2017 and Mr. Harlow’s banking experience, knowledge of the Oklahoma City market and the markets we serve make him well qualified to serve as a board director. | |

|

| |

Mautra Staley Jones (45) | Dr. Jones is the

| |

|

| |

Bill G. Lance | Mr. Lance is the Secretary of State for the Chickasaw Nation. Mr. Lance was the Secretary of Commerce for the Chickasaw Nation from 2009-2022 and Mr. Lance’s executive management experience, his public service, and his extensive civic involvement make him well qualified to serve as a board director. | |

Dave R. Lopez | Mr. Lopez served as Secretary of State of the State of Oklahoma from March 2017 to March 2018. Prior to that he was an independent executive consultant. Mr. Lopez’s executive management experience, his public service, and his extensive civic involvement make him well qualified to serve as a board director. | |

15

|

| |

William Scott Martin | Mr. Martin was a principal shareholder and Chairman of the Board of both First Wagoner Corporation and First Chandler Corp., until their merger into BancFirst Corporation in January 2018. He is Mr. Martin’s executive management experience in banking, along with his knowledge and awareness of the communities we serve, make him well qualified to serve as a board director. | |

Tom H. McCasland, III | Mr. McCasland has been President of Mack Energy Co., a privately-owned exploration and production company, since 1996 and was a community director of BancFirst Duncan from 1998 to 2015. Mr. McCasland has been a director of Investors Trust Company, an Oklahoma-chartered trust company, since 1984. He previously served on the Board of Directors of Cache Road National Bank of Lawton, Oklahoma, and Charter National Bank of Oklahoma City, Oklahoma. Mr. McCasland’s extensive business and management experience in the oil and gas industry, together with his | |

13

David E. Rainbolt | Mr. Rainbolt became Executive Chairman of both BancFirst Corporation and BancFirst in May of 2017. He was elected Chairman of the Board of BancFirst Corporation in March 2017 and has served as Chairman of BancFirst since 2005. He was President and Chief Executive Officer of the Company from January 1992 to May 2017 and was Executive Vice President and Chief Financial Officer of the Company from July 1984 to December 1991. He currently serves on the board of OGE Energy Corp., a public company engaged in the energy delivery business. Mr. Rainbolt’s executive management experience in banking, and specifically in bank acquisitions and corporate finance, along with his knowledge and awareness of the communities we serve, make him well qualified to serve as a board director. | |

|

| |

Robin Roberson | Ms. Roberson is the Senior Vice President of Platform Partnerships for Eberl Claims Service, a nationwide leader of daily and catastrophic claims services. Previously, she was Managing Director, North America for Claim Central Ms. Roberson’s extensive business and management experience make her well qualified to serve as a board director. | |

Darryl W. Schmidt | Mr. Schmidt was appointed Chief Executive Officer of BancFirst in May of 2017. Mr. Schmidt was Chief Credit Officer of the Company from 2002 to 2015. Beginning in 2007 he served in a dual role as Chief Credit Officer and Director of Community Banking until late 2015, at which time these roles were again separated. He has been a director of BancFirst since 2003. Mr. Schmidt’s banking experience and knowledge of the markets we serve throughout Oklahoma make him well qualified to serve as a board director. | |

16

|

| |

Natalie Shirley | Ms. Shirley Ms. Shirley’s extensive business and management experience, along with her understanding of the state we serve, make her well qualified to serve as a director. | |

14

Michael K. Wallace | Mr. Wallace has been the President and owner of Wallace Properties, Inc. and Mike Wallace Homes, Inc., privately-owned real estate development and homebuilding companies, since 1994. Mr. Wallace Mr. Wallace’s extensive business and management experience, together with his knowledge and awareness of the communities we serve, makes him well qualified to serve as a board director. | |

Gregory G. Wedel | Mr. Wedel has been managing partner of Wedel Rahill & Associates, CPAs, PLC since 1984. He started his career in public accounting with Peat Marwick (now KPMG). Mr. Wedel is a member of the American Institute of Certified Public Accountants and the Oklahoma Society of Certified Public Accountants. He previously served on the Board of Directors and credit committee of Mr. Wedel’s extensive business and management experience, together with his accounting knowledge, makes him well qualified to serve as a board director. | |

G. Rainey Williams, Jr. | Mr. Williams has been President of Marco Holding Corporation, a private investment partnership, and its predecessors, since 1988. He is a member of Mr. Williams’ extensive business and investment experience, together with his |

Advisory Director.In addition to the nominees for director to our Board listed above, Greg G. Morse, CEO of Worthington Bank serves as an advisory director. Neither Mr. Morse nor any other employee director of the Company receive any compensation in connection with their role as an advisory director.

15

17

Board Structure and Committee Composition

As of the date of this proxy statement,Proxy Statement, our Board of Directors consists of 17 members. The Company also has 21 directors andone advisory director who does not vote. The Company has the following six standing committees: (1) Executive Committee, (2) Audit Committee, (3) Compensation Committee, (4) Independent Directors’ Committee, (5) Board Issues Committee, (6) Information Security Committee, and (6)(7) Sustainability Committee. The committee membership and meetings during the last fiscal year and the function of each of the standing committees are described below. During fiscal 2020,2023, the Board held 12 meetings. Each current director attended at least 75% of all Board and applicable standing committee meetings. Directors are encouraged to attend the annual meetings of the Company’s shareholders. All then-current directors, with the exception of Frank Keating, Bill G. Lance, Dave R. Lopez,Mautra Staley Jones and Robin Roberson,Tom H. McCasland III, attended the previous annual meeting of shareholders.

| Name of Board Committee |

|

| ||||

Name of Director | Executive | Audit | Compensation | Independent Directors | Board Issues |

| Sustainability |

Dennis L. Brand | Chairman |

|

|

|

|

|

|

C. L. Craig, Jr. |

|

|

| Member |

|

|

|

F. Ford Drummond |

|

| Member | Member |

|

|

|

Joseph Ford |

| Member | Member | Member |

|

|

|

Joe R. Goyne |

|

|

|

|

|